The Problem With CRM Bookings: In our recent product update, Opportunities Acceleration, we described how one of the biggest problems with CRM systems is how close dates are entered by sales reps. Research conducted by our data science team indicates that the close dates forecasted by sales teams are often likely just placeholders in the best case, and often “fake news” in the worst case (totally made up). Taking a step back and thinking about why this is the case paints a clear picture. The CRM close date is a required field. This forces a rep to enter a close date as soon as they create an opportunity, when they really haven't had any chance of truly understanding what that date might be. Although human intuition is often amazingly accurate and helpful, when it comes to estimating sales cycle length sales numbers it is definitely not. Why? Because there are inherent issues with way reps enter close dates. For example, they’re more likely to enter dates at the end of the month because then they have a buffer period if the deal takes longer than when they think it’ll actually close. In addition to the fact that reps just simply have no choice but to enter a placeholder due to current sales process as determined by CRM systems, there are more psychological factors in play. Close dates projections suffer from very specific cognitive biases: choice-supportive bias (the tendency to retroactively ascribe positive attributes to an option one has selected); bandwagon effect (the rate of uptake of beliefs, ideas, fads and trends increases the more that they have already been adopted by others); and certainly confirmation bias (the tendency to search for, interpret, favor, and recall information in a way that affirms one's prior beliefs or hypotheses). Moreover, there is no way that a singular, likely overloaded sales rep can synthesize all the data points present about the current deal/past deals similar to the one at hand and draw a meaningful conclusion in the form of a super accurate close date. This has a compounding effect of messing up overarching CRM forecasting. This is where artificial intelligence can help. We’re excited to announce our latest update: Bookings Timeline. Read on to learn more about how it works. Validate Your Close Date

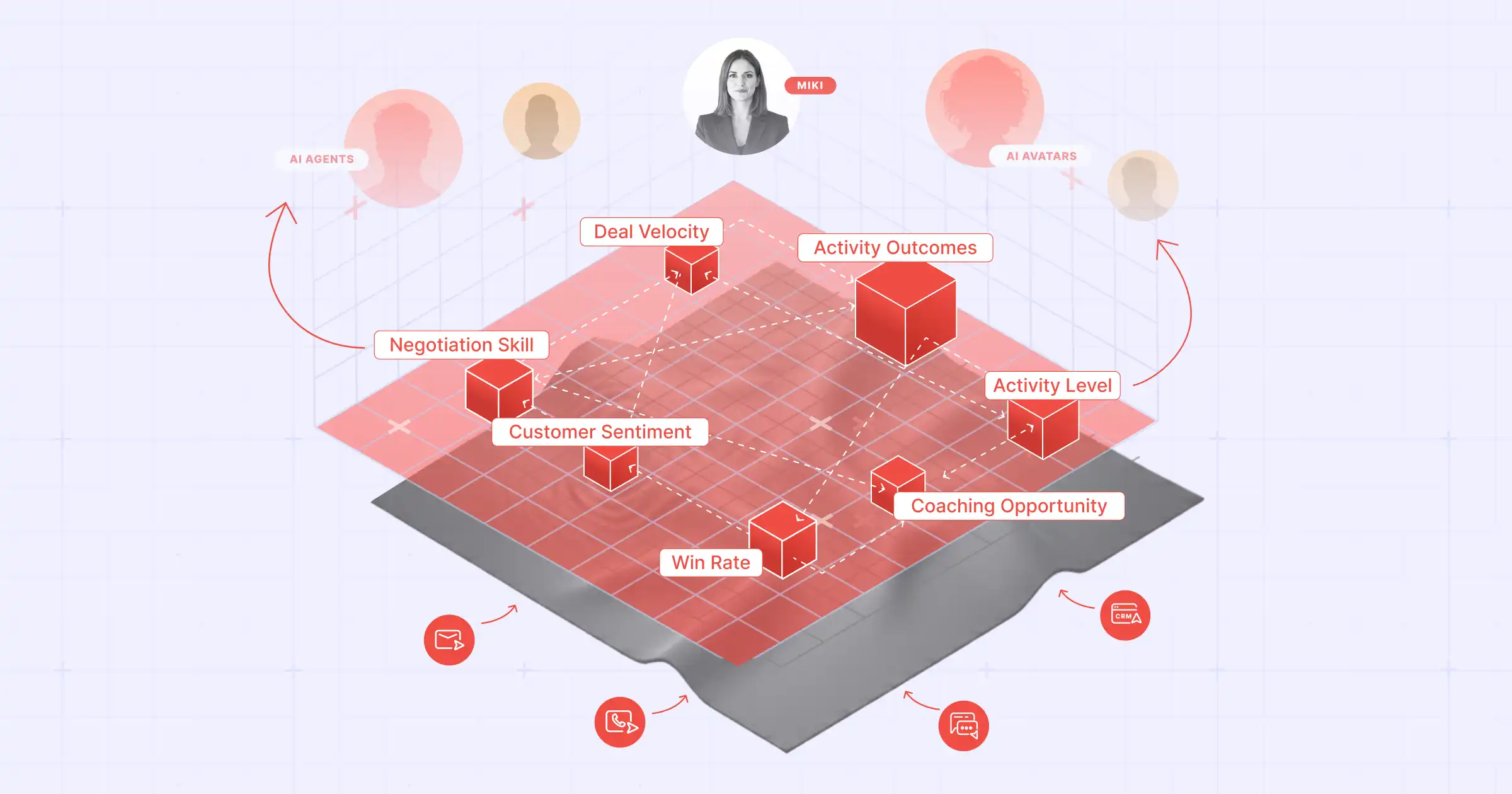

Bookings timeline uses AI to validate your CRM entered close date. This feature will tell you that if the deal closes, it is likely to close either earlier or later than your projected CRM-entered date. Basically, we will take the guesswork away from the initial placeholder date. As we’ve learned, the CRM entered close date is based on gut feelings, so seeing exactly how gut-feel it is is super helpful for reps to course correct. This is key because it prevents a pain every sales team faces but doesn’t need to anymore -- finding out too late in the quarter that a deal is slipping. Bookings Timeline Explained Since machine learning powers this new feature (and Aviso's entire platform!), Bookings Timeline calculates when your deals will actually close based on your organization’s unique history. Each Booking Timeline includes the top factors influencing the prediction.

Late: Aviso thinks the deal is going to close MORE than a week later than you predicted in CRM

Early: Aviso thinks the deal is going to close LESS than a week later than you predicted in CRM

Probability (shaded in blue): The most likely close date time-zone

>> Fast Forward: Reason Aviso thinks the deal will get delayed

<< Rewind: Reason Aviso thinks the deal will be ahead of schedule

Green Target: Reason deal close date is more trust-worthy

Red Expansion: Reasons to believe close-date isn’t trust-worthy

Cross-referencing In-Quarter or Out-Quarter With Booking Timeline, you can cross reference Aviso’s projected close date with the quarter bounds to determine if the opportunity is more likely to close in the current quarter or the next. This helps companies determine in their Monday forecast calls and deal reviews how and where a forecast needs to be adjusted.