Surviving and Thriving After a Black Swan

Mar 26, 2020

Notice: To help companies push through uncertain times, we are currently offering Aviso AI for free for 90 days.

Those of us who read Nassim Taleb’s book Black Swan know we’re experiencing a major shock event. Here are just some of the things you are likely to hear in the coming months

● “We would have won, but the other team just gave the deal away”

● “Because we missed intermediate milestones doesn’t mean we won’t hit our schedule”

● “We have high churn, but as soon as we redo our marketing, people will come back”

At the end of the Dot Com bust, when large companies like SAP, Oracle, and Siebel began to miss their quarters in spades, many wondered why no one saw it coming. After all, these companies knew a slowdown was inevitable as their customers went off the cliff, but despite early warnings, each CEO reiterated strong guidance right up till the point of the actual misses. The same thing in 2008 with companies ranging from Lehman Brothers to Salesforce. When asked why these great CEOs would not have seen it coming, Andy Grove simply said: “They were not lying to investors, but rather, they were lying to themselves.”

Humans often take actions on positive indicators (good news) and look to explain away negative leading indicators (bad news). After COVID, our own human biases are more amplified. For CEOs and CROs, trust in their sales team has to be balanced with vigilance in the actual sales process, cadence of activities, and customer engagement levels. In this post I’ll focus on the uncertainty created by COVID-19 and how we can get through this crisis. In this time, we need new kinds of leading indicators and looking back at similar events helps build a clearer picture of how to get through this crisis. At Aviso, we believe learning from the lessons of the past is the first step in surviving not just COVID-19 and its impact over the next 12 -18 months, but also preparing for other Black Swans. To grasp fully how this rapidly evolving situation is unique, let’s start with a comparative analysis with previous shocks such as the 1987 Stock Market Crash, 2008 Recession, and 9/11. Though every Black Swan event in the past has had defining risk factors such as global/local economic and political conditions, credit, market, liquidity, or country -specific risk, what makes the COVID-19 timeline different is our exponential increase in global connectedness. The financial market devastation is just the tip of the iceberg. What’s most striking, is the pace at which this virus has eroded consumer sentiment and pulled the world into a Bear market.

The real iceberg is still unseen. Researchers are predicting the fallout of this novel virus to be far greater reaching than any other disease related pandemic. What is regarded by many as a largely positive societal development -- globalization -- has now become our Achilles heel over the past 2 decades. From highly accessible air travel to fragile multi-level supply chains, to seamless corporations, the same things that powered us are now making us vulnerable.

So how exactly will my business be impacted?

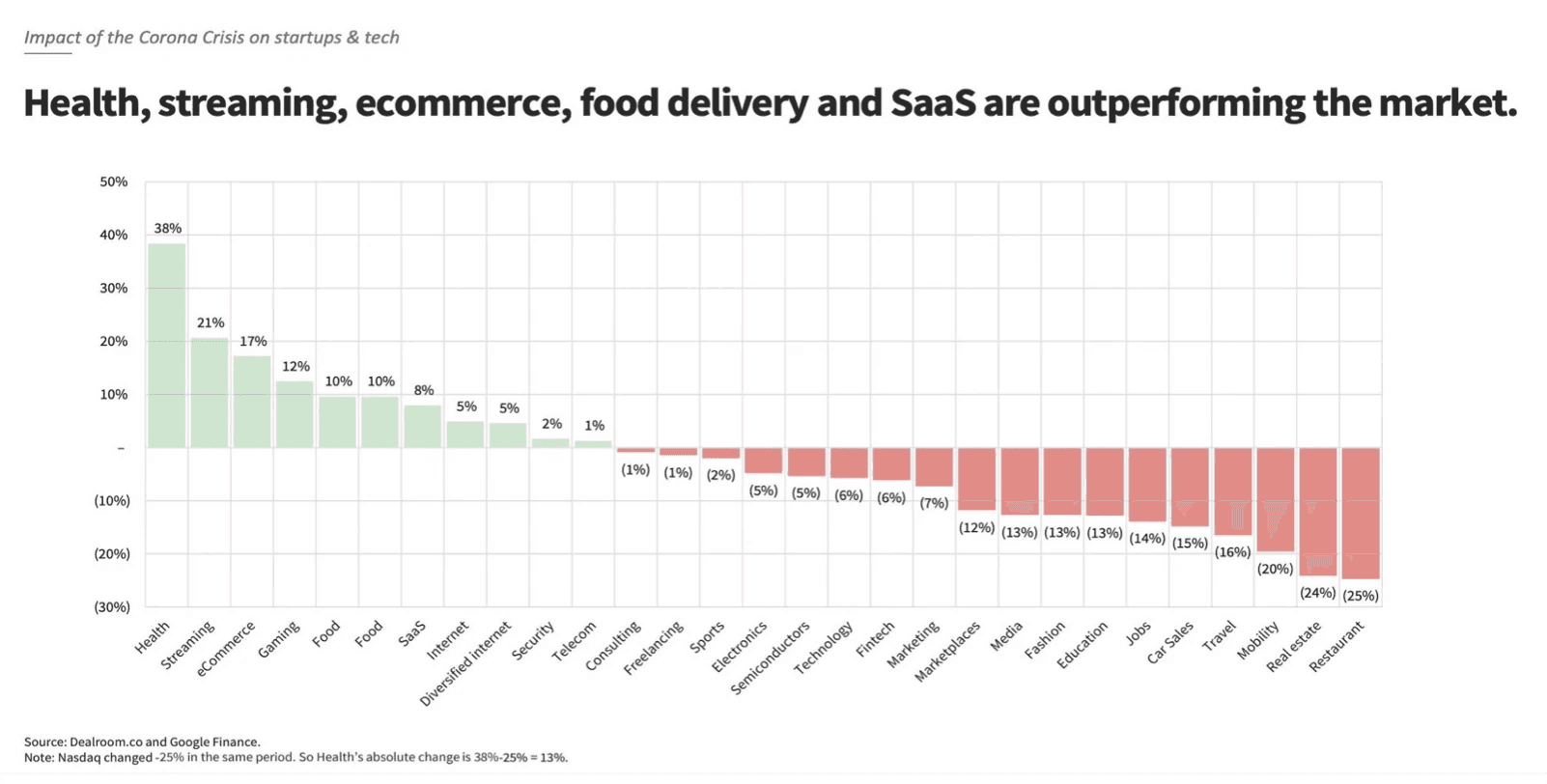

It is important to look at the macro-indicators first. Per Yahoo “the number of Americans filing for unemployment is expected to have skyrocketed to a record-breaking 1.64 million for the week ending March 21, according to economists polled by Bloomberg. The previous record was 695,000 claims filed the week ended October 2, 1982. Initial jobless claims for the week ended March 14 jumped by 70,000 claims to 281,000 and was the largest single-week increase since the Great Recession.” But not all industries are equally affected. Consider the chart below. If you are in restaurants or real estate, this feels like Doomsday. If you are in Health or Streaming, it feels different.

The extent of the impact your industry faces ultimately depends on a variety of factors: financial resilience, sales cycles, geographical exposure, churn versus new customer acquisition rates, account sizes. All these factors are key considerations that you should be modeling into your business to forecast Q2, Q3, and Q4 and even FY ‘22.

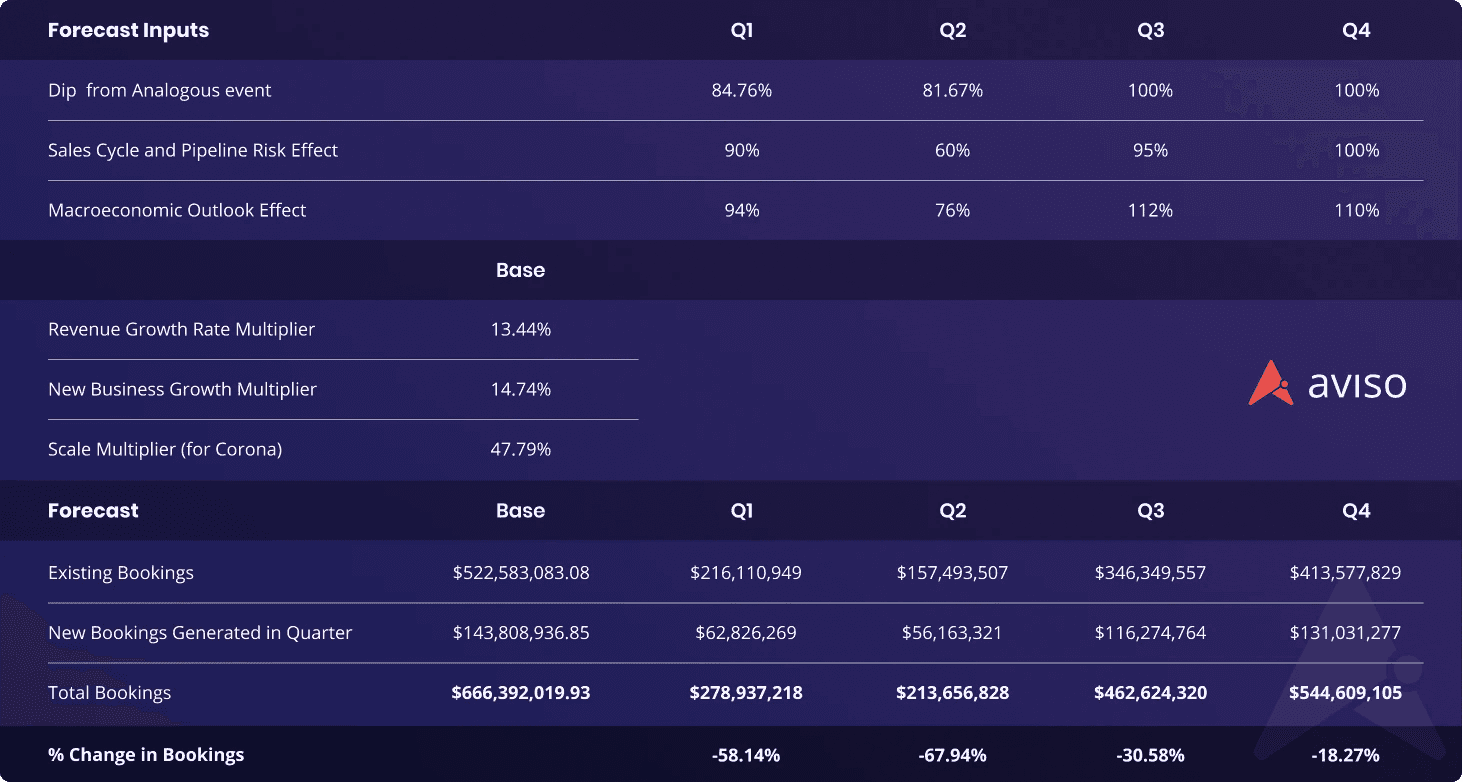

Novel business problems need novel technology solutions

COVID-19 is a result of a “novel” virus. The word novel here has a specific scientific meaning. To understand the impact of a novel virus on your business, a starting point can be similar challenges experienced in the past, and how revenue forecasts dropped in those situations. The problem lies in the fact that most companies haven’t faced a comparable set of challenging events or were at a very different state of operation when they faced that situation and hence making it difficult to compare. A workaround can be to look at an analogous set of companies and look at the respective indicators. Additionally, you have to look at more dimensions of risk than you did previously. For e.g. the risk in sales is not just limited to your own geography, but also spans the geographies your clients operate in. At Aviso, we believe in a time series approach to business uncertainty. We apply Data Science to understand the differential impact across different companies & industries, across multiple past quarters, and rebasing forecasts not only for current quarter, but also next few quarters. All of these factors are ingested and analyzed by Aviso’s AI Engine. Following is a snapshot with data masked by Aviso for one of its Fortune 500 clients.

De-risking CRM fake news with the strength of multiple signals

A key challenge faced by companies during Black Swan events is that their CRM and deal data loses its trustworthiness. This is due to many deals drying up as poor economic conditions lower buyer intent. However, it is important to note that CRM is a lagging indicator of lost business. Companies then often hire analysts to build fancy spreadsheets but ultimately resort to a heuristic method of calculating a downgrade multiplier of their forecasts. Aviso addresses this problem by looking at signals other than CRM to capture a live pulse. Here are just two ways in which Aviso creates a reliable AI forecast versus one via heuristics.

● Tracking the slowdown signal from Account Executive engagement and activity and intent management looking at the raw exhaust of emails, meetings, and virtual or in-person conversations

● Gauging the temperature of the deal from forecast meeting transcripts, looking not just at keywords but also sentiment analysis

● Looking at marketing activities variance, e.g. leads drying up, fallout in engagement activities Aviso also looks at the opportunity level and analyses pipeline risk at a deal level based on whether the sales cycle for that deal is delayed or not, and several other factors such as sentiment tracking in external conversations with prospects and customers.

Using AI with multiple signals to forecast and guide growth

Where traditional AI approaches in Sales focus on narrow slices of the process aiming to "improve" that slice for e.g. just tracking emails, or recording sales calls, or enabling sales reps, we approach Sales from a different angle that makes our forecasts robust and reliable. Instead of pre-identifying slices of the current process and trying to improve them, Aviso looks at all disparate data sets generated during a sales cycle (e.g. raw data in CRM, activity data from calendar, deal room conversations, and support and success tools), combine them into a single opportunity focused view, and generate training data and models which allows us to decode and isolate the human behavior which drives sales for each individual customer. This allows us to decode not only explicit behaviors (judgement on moving stages, categories etc), but also implicit behaviors (when are these values being changed and their sequencing). Aviso’s AI uses advanced machine learning for feature discovery and model building. Aviso bootstraps history from the source systems of its customers, discovers the most predictive features for that customer and builds an ensemble of predictive models. As customers use the product, our temporal database builds a history of all data sources which our ML engine uses to retrain these models as the business and the market conditions change. Predictions from Aviso’s models are generated as insights, timely nudges and team-wide actions. Our temporal database also allows us to backtest predictions in the past and see how new model types, feature selection techniques or data sources provide gains over a wider past period. We believe AI is a new compass to guide sales and go-to-market teams to close more deals, accelerate growth, and find their revenue True North. Aviso delivers true revenue intelligence, nudges team-wide actions, and gives precise guidance so sellers and teams don't get lost in the fog of customer databases, scattered data lakes, and inherent human biases.

How Aviso’s AI Compass can help you right now

Every crisis presents its own opportunities. As Sequoia Capital’s “Black Swan” blog post said: "In downturns, revenue and cash always fall faster than expenses. As Darwin surmised, those who survive are not the strongest or the most intelligent, but the most adaptable to change.” At Aviso, we predict a “U” shaped downturn with expected impact of 1-2 quarters. Firms which can manage revenue with AI now will have an edge going forward, but they will need:

● New crystal ball that looks beyond CRM (a lagging indicator) to forecast revenue ● New virtual channels to stay closer to teams and customers during remote work

● Nudges, not force, to help reps course correct while automating CRM data entry Aviso’s AI platform can help mitigate risk and manage revenue growth with:

● Accurate Forecasting & Pipeline Planning: Using signals beyond CRM, such as emails, call recordings, meetings, relationship maps, support tools, Aviso finds the biggest risks to deliver accurate forecasts. Aviso also helps with pipeline and opportunity “nudges”, tracking across regions, renewals and run-rate business and addresses at-risk deals with upside deals & pull ins from future quarters

● Remote Deal Collaboration: Many of us are working remote and virtually. Aviso collaboration, forecast and deal rooms enable Reps, Managers, Customer Success, Sales Ops, Finance, IT, and Executives to virtually collaborate across time zones – giving you the best of Slack, Zoom, and Chatter. In Forecast rooms, Sales teams can access AI insights to identify deals at risk and collaborate on deals that have a higher chance of closing in the current quarter. In Deal rooms, Reps and Managers can use AI insights on performance and have better coaching discussions for longer-term impact.

● CRM Burden & Cost Takeout: Aviso can save CFOs 25-30% cost by eliminating non-core licenses. It also reduces reliance on CRM data entered by sales reps alone to drive forecast accuracy, while automating admin data entry that takes 25% or more of their time. Aviso integrates reps' email and calendar to auto-populate contacts and meetings into CRM, and also tracks Marketing system activity (or lack of). This improves rep productivity, provides Sales Managers with 100% visibility on activity management, and delivers a more accurate forecast to Executives to help close the quarter strong.

In Closing:

At Aviso, we’ve worked for over 6 years to help Fortune 500 and high growth companies to optimize forecasts and revenue execution. We’re here to help you survive and thrive. I’ll end with two quotes via Ben Horowitz, someone whose writing on Peacetime CEO/Wartime CEO is more relevant than ever before.

“Cause right now you’re just a liar a straight mentirosa today u tell me something y manana es otra cosa” — Mellow Man Ace, Mentirosa

“Just win baby.”—Al Davis