Tech Stack Consolidation: A Revenue Operations Playbook for the No-App Future

Jan 14, 2026

For more than a decade, revenue organizations have equated progress with software accumulation. Each new challenge introduced a new tool. Forecasting gaps led to forecasting software. Coaching gaps led to conversation intelligence. Enablement gaps led to content platforms. Over time, the GTM stack grew broader, heavier, and harder to manage.

What emerged was not a modern revenue engine, but a fragile one. Context scattered across systems. Decisions slowed by reconciliation. Sellers are trapped in workflows that optimize reporting over execution. The irony is hard to miss. Teams invested in technology to move faster, yet productivity declined, and predictability eroded.

For CTOs and CROs, this is no longer an operational annoyance. It is a structural constraint on growth.

Tech stack consolidation has traditionally been framed as a cost-control exercise. In reality, it is something far more strategic. It is the prerequisite for the next era of revenue execution, where intelligence, not information, becomes the competitive edge.

The Hidden Cost of the Frankenstack

Today’s GTM teams are not under-tooled. They are overburdened.

The average GTM team now operates with 10+ tools across sales, marketing, RevOps, enablement, forecasting, and customer success. Each tool was purchased to solve a specific problem. Together, they create a system that no one fully understands.

The impact is measurable. According to Gartner, 25% of provisioned licenses go unused, representing direct software waste and sunk cost. More damaging is the hidden operational tax. 40% of seller productivity is lost to context switching as reps bounce between CRM, forecasting tools, conversation intelligence, engagement platforms, and spreadsheets just to piece together a single view of a deal. Time that should be spent advancing opportunities is consumed by navigating tools and reconciling data.

Fragmentation also breaks execution. CRM captures activity but not meaning. Forecasting tools rely on stale snapshots instead of live context. Conversation intelligence surfaces insights that never reach pipeline decisions. Enablement platforms push content without knowing which deals are at risk. Each system works in isolation, forcing humans to act as the integration layer.

The result shows up at the bottom line. 67% of reps missed quota last year, not because of effort, but because execution slowed under the weight of tool sprawl. Revenue leaders spend cycles validating numbers instead of acting on them. RevOps teams spend weeks assembling forecasts and QBRs instead of improving the system itself.

This is the real cost of the Frankenstack. Not just licenses, but lost time, reduced productivity, delayed decisions, and stalled revenue momentum.

Why Consolidation Is No Longer Optional

We are at the middle of a fundamental shift in how revenue systems create advantage.

In the last era, information was the edge. Then intelligence became the edge as AI entered the enterprise. Today, that advantage is disappearing. Intelligence is being democratized. Large language models, analytics, and AI features are rapidly becoming table stakes. What will differentiate revenue organizations next is not access to AI, but the application of intelligence in real execution.

This is why point sales apps are no longer the future.

The next frontier is a No-App Future, where work is not done by navigating dashboards and workflows, but by AI agents acting on behalf of revenue teams. The interface shifts from applications to conversation. From clicking to delegating. From reporting to action.

But AI agents cannot operate in a fragmented world.

Traditional GTM stacks were built for apps, not agents. They fragment context across CRMs, forecasting tools, conversation intelligence, enablement platforms, and spreadsheets. In that environment, AI becomes just another layer bolted on top—impressive in demos, but brittle in production. Agents lack continuity, shared memory, and a consistent understanding of how the business actually runs.

Tech stack consolidation is how organizations cross the bridge to the No-App Future.

Consolidation creates the unified data model, shared intelligence, and execution fabric that agents require to operate end-to-end across the revenue lifecycle. It turns disconnected systems into a single operating system for revenue, where intelligence can be applied continuously, not episodically.

For CTOs, this is an architectural mandate: building a foundation where agents can reason, remember, and act.

For CROs, it is an execution mandate: moving from tool-driven workflows to outcome-driven revenue motion.

They are not separate problems. They are the same shift viewed from different seats.

Step One: Stop the Bleeding

Every successful consolidation journey begins with stabilization.

Most organizations add tools to compensate for broken workflows rather than fixing the underlying system. Forecasts move to spreadsheets because CRM snapshots are unreliable. QBRs live in decks because dashboards cannot reflect nuance. Managers rely on intuition because systems lag reality.

The first move is to reduce friction. This means absorbing fragmentation without forcing disruption—connecting to existing systems, synchronizing data bi-directionally, and introducing time-aware views of pipeline and forecasts so teams no longer have to reconcile numbers by hand. Early gains come from eliminating exports, duplicate updates, and manual hygiene work, creating immediate relief without a rip-and-replace.

Many consolidation efforts stall here by mistaking stabilization for completion. In reality, this step simply clears the debris so real rebuilding can begin.

Step Two: Build a Unified Revenue Foundation

Once noise is reduced, the real work starts.

Most GTM environments lack a unified data model that reflects how revenue actually operates. Sales, marketing, finance, and customer success all interact with the same customer, but through different lenses. Metrics drift. Definitions change. Trust erodes quietly.

A consolidated revenue stack requires a shared foundation where data is modeled consistently across the lifecycle. This foundation must support time-series reasoning, complex hierarchies, and evolving business logic. It must capture not just what happened, but how it changed over time.

Without this layer, consolidation merely centralizes fragmentation. With it, revenue teams gain a stable substrate for intelligence.

This is the architectural inflection point that CTOs recognize immediately. Systems that reason over time behave fundamentally differently than systems that report static states.

Step Three: Activate Shared Revenue Memory

Data alone does not create leverage. Memory does.

High-performing revenue organizations do not simply track metrics. They learn from patterns. They recognize which signals precede slippage, which behaviors correlate with wins, and which interventions change outcomes. Today, that learning is distributed across people, meetings, and tribal knowledge.

Activating shared revenue memory means embedding that learning into the system itself. Historical deal paths. Forecast adjustments. Coaching outcomes. Execution precedents. All retained, connected, and accessible.

At this stage, consolidation becomes transformative. The stack evolves from a set of tools into a learning system. Decisions improve not because dashboards look cleaner, but because the system remembers what worked, what failed, and why.

Step Four: Make AI the Interface, Not the Feature

Only once foundation and memory are in place does AI reach its full potential.

In a consolidated environment, AI stops being a feature and becomes the interface to work. Revenue leaders no longer navigate applications. They ask questions. Sellers no longer search for insights. They receive guidance. Managers no longer chase updates. They act on live intelligence.

This shift is profound. Natural language replaces dashboards. Conversations replace navigation. Agents operate across systems, pulling context, detecting risk, and executing actions without forcing humans to switch tools.

This is the practical manifestation of the No-App Future. Applications still exist, but they recede into the background. Intelligence moves to the foreground.

At Aviso AI, this is the core belief behind consolidation. AI agents only work when intelligence is unified. Otherwise, they simply automate fragmentation.

Step Five: Collapse Tools by Collapsing Context

Most GTM stacks are large because context is fractured.

Forecasting tools exist because CRM snapshots are insufficient. Coaching platforms exist because insights are disconnected from execution. Enablement tools exist because content is detached from deal reality.

This is why traditional consolidation efforts often fail. They remove tools without addressing the underlying reason those tools were needed in the first place.

True consolidation happens when context itself becomes unified.

When context is unified, entire categories of tools become redundant. Forecasting becomes continuous rather than episodic. Coaching becomes situational rather than generic. Enablement becomes adaptive rather than static.

This is why consolidation accelerates once intelligence is shared. The stack does not shrink because of procurement mandates. It shrinks because it no longer needs compensatory layers.

Step Six: Redefine Revenue Operations

As the stack consolidates, the role of Revenue Operations must evolve.

In fragmented environments, RevOps acts as a service desk. They reconcile numbers, build reports, and answer endless ad hoc questions. In consolidated environments, RevOps becomes a systems architect.

They define metrics. Govern semantics. Orchestrate agent behavior. Ensure that intelligence aligns with strategy. Their work shifts from maintenance to leverage.

This evolution is critical. Without it, organizations risk recreating old processes inside new platforms. With it, consolidation becomes durable rather than cosmetic.

Aviso’s Unified GTM Tech Stack: One System, End-to-End

Today's GTM tech stack has become an expensive, fragmented mess. Tools like Outreach, Clari, 6sense, Gainsight, Gong, LeanData, RB2B, Clay and Salesforce created data and organizational silos and integration nightmares that have tanked sales performance.

Aviso was built to replace this model entirely.

Aviso is the enterprise AI operating systems of the future; a single, AI-powered GTM platform with autonomous agents, replacing this fractured tech stack with a unified system for superior sales results and significant cost savings.

Leading enterprises including Druva, Nutanix, LogicMonitor, Lenovo, HPE, CDW, BMC, NetApp, and hundreds more have consolidated their GTM stacks with Aviso—cutting sales technology costs by 40% or more, including reductions in Salesforce and surrounding point tools. More importantly, these teams are now on a clear path to AI-first, agent-driven revenue execution, with Aviso as the foundation.

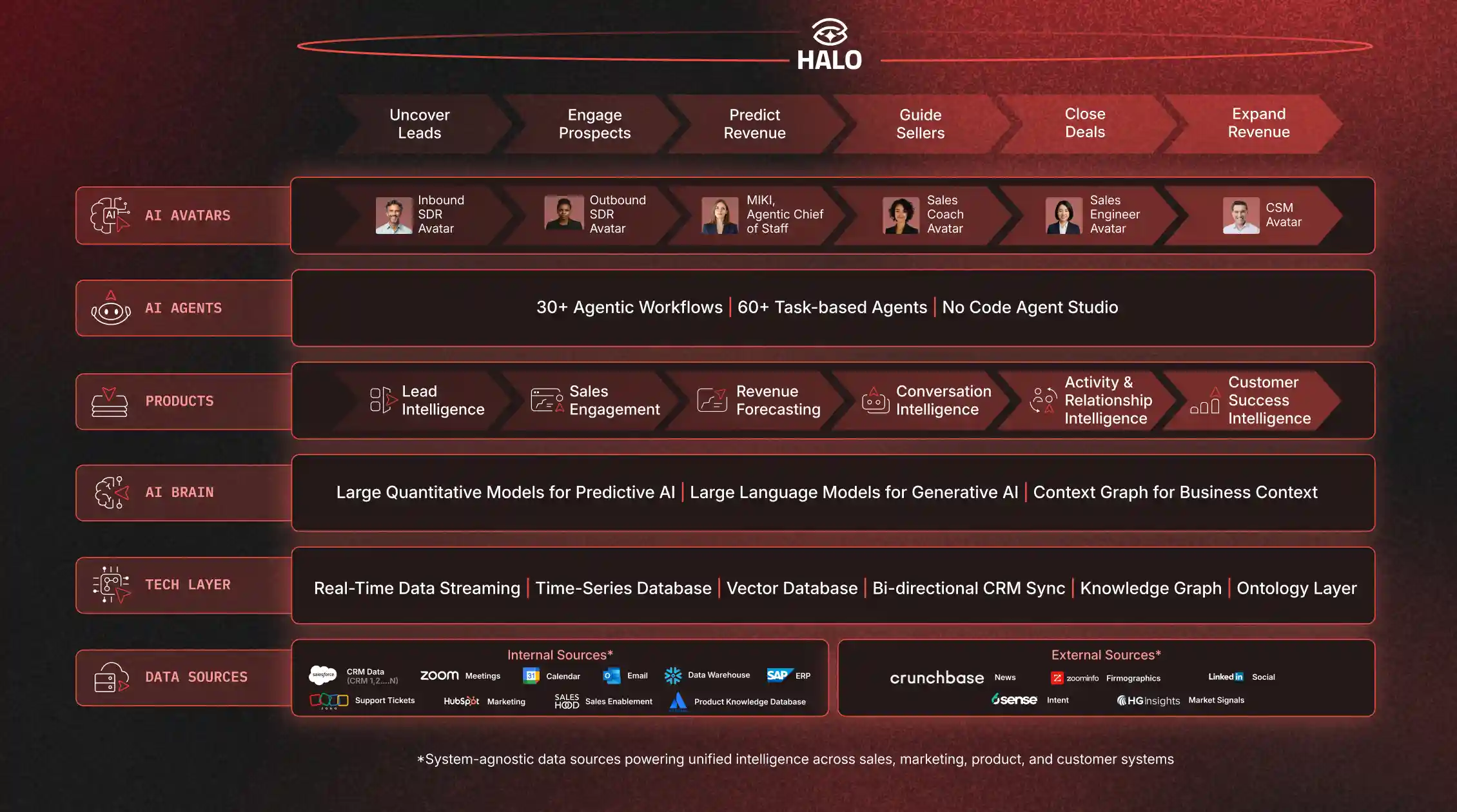

Aviso’s unified GTM tech stack is organized as a coherent system, not a collection of apps. Each layer builds on the one below it, enabling consolidation without loss of capability.

1. Data Sources: System-Agnostic, Enterprise-Wide

Aviso connects directly to both internal and external systems of record without requiring data migration.

Internal sources include CRM, ERP, meetings, calendars, email, marketing automation, support tickets, sales enablement systems, and data warehouses. External sources add firmographics, intent data, market signals, and social context.

Data remains where it belongs. Intelligence does not. Aviso unifies it.

Tech Layer: The Execution Backbone

The Tech Layer is the foundational infrastructure that enables Aviso’s AI to operate in real time, at enterprise scale, and across fragmented GTM systems. It is designed to ingest, synchronize, store, and reason over revenue data continuously, without being constrained by any single CRM or application.

Real-Time Data Streaming: Continuously captures live CRM, deal, activity, and conversation signals so AI decisions and forecasts reflect the current state of execution.

Time-Series Database: Preserves the full history of deal movement, forecast changes, and rep behavior to detect trends and train accurate predictive models.

Vector Database: Transforms unstructured data into semantic meaning so AI can find relevant insights even when language differs.

Bi-Directional CRM Sync: Syncs securely with CRM systems, enriching CRM data with context and pushing insights back without disrupting seller workflows.

Knowledge Graph: Models accounts, deals, users, products, and relationships to provide structured grounding for enterprise AI reasoning.

Ontology Layer: Defines business metrics, entities, and rules to ensure AI operates on your company’s true definitions, not inferred assumptions.

3. AI Brain: Quantitative Reasoning + Business Context

The AI Brain is where Aviso fundamentally diverges from app-centric and prompt-driven systems.

This layer combines Large Quantitative Models (LQMs) for forecasting, risk modeling, and time-series reasoning with predictive AI models that continuously learn from outcomes. These models do the actual decision-making work.

LLMs sit on top as the interaction layer, explaining, summarizing, and operationalizing decisions that are already grounded in quantitative reasoning—not inventing them.

Context is established through Aviso’s Context Graph, built on a Knowledge Graph and an Ontology layer that define business meaning, metrics, hierarchies, and relationships. This ensures every AI decision understands what is happening, why it matters, and how success should be evaluated.

4. Products: Intelligence, Not Point Apps

Instead of standalone applications, Aviso delivers integrated intelligence capabilities that collapse entire tool categories: Lead Intelligence, Sales Engagement, Revenue Forecasting, Conversation Intelligence, Activity & Relationship Intelligence, Customer Success Intelligence.

Because these capabilities share the same data model, memory, and context, they work together natively, eliminating the need for disconnected forecasting tools, engagement platforms, coaching software, and analytics layers.

5. AI Agents: Autonomous Execution at Scale

AI Agents automate standard GTM workflows end-to-end.

With 30+ agentic workflows and 60+ task-based agents, Aviso handles pipeline hygiene, forecast adjustments, activity capture, risk detection, deal progression, and operational follow-through. A no-code agent studio allows RevOps teams to evolve execution logic without engineering dependency.

This is how work gets done without apps.

6. AI Avatars: Productivity for Every Persona

AI Avatars work alongside real GTM roles to improve productivity, not replace judgment.

Purpose-built avatars like the Inbound SDR, Outbound SDR, Sales Engineer, Sales Coach, and Customer Success Avatar handle qualification, prospecting, deal support, coaching, and renewals autonomously. Each avatar supports its persona with insights, guidance, and execution grounded in shared intelligence, saving reps 20+ hours a week.

MIKI, Aviso's Agentic Chief of Staff orchestrates actions across Agents, flagging risks, surfacing next steps, running QBRs, and ensuring pipeline alignment.

Halo sits above the stack as the visual AI interface for users.It is the first true AI Single Pane of Glass built to reduce non-revenue activity and help every rep stay on plan. Halo connects the entire revenue workflow in one place, guiding sellers through what to focus on, how to prepare, and when to act.

The Outcome: Real Consolidation, Real Results

This is what true tech stack consolidation looks like.

Fewer tools. Fewer integrations. Less context switching. Lower cost. Faster execution. Better decisions. AI that actually works in production.

Aviso does not simply reduce software sprawl. It replaces it with a system designed for agentic, AI-first revenue execution, turning the No-App Future from a vision into an operating reality.

Consolidation as a Growth Strategy

Tech stack consolidation is not about doing more with less software. It is about doing more with less friction.

For CTOs, it is the path to a cleaner, more resilient architecture that can support agentic systems at scale. For CROs, it is the path to predictable execution in an increasingly complex selling environment.

The next era of GTM will not be won by teams that simply “adopt AI.” AI is already ubiquitous. The advantage will belong to organizations that consolidate intelligently enough to let AI operate end-to-end, with shared context, memory, and execution authority.

The No-App Future does not arrive through experimentation or bolt-on pilots. It arrives through deliberate consolidation—replacing fragmented point solutions with a unified revenue system that can think, learn, and act as one.

The path forward is clear:

start by identifying where tool sprawl is slowing execution,

stabilize by unifying data and context,

and build toward an AI-first operating model where agents, not apps, drive outcomes.

This is how fragmented GTM stacks become unified execution engines.

And this is the real promise of tech stack consolidation.

See what this looks like in your environment. Book a demo with Aviso to understand how leading enterprises are consolidating their GTM stack, reducing costs, and accelerating AI-driven revenue execution.