The 1 Metric CRO's use to keep pace

Jan 31, 2019

We spend a significant amount of time collaborating with customers’ CROs to help them optimize their sales organizations and drive pipeline. The metric that gets the most attention is the exact close rate percentage by forecast category throughout the Quarter. Time and time again, when we show CROs their actual close rate by commit, upside, pipeline, and whatever their categories are, they are surprised that the percentages are so low. They often respond with the statement that “it’s probably an anomaly because that Quarter we had some deals that were unique, significant in size, new marketing programs that generated different kinds of leads, etc.” But then when we show three or four trailing quarters and they prove to be consistent, they lean forward and take notice.

Exact Close Rate Percentage

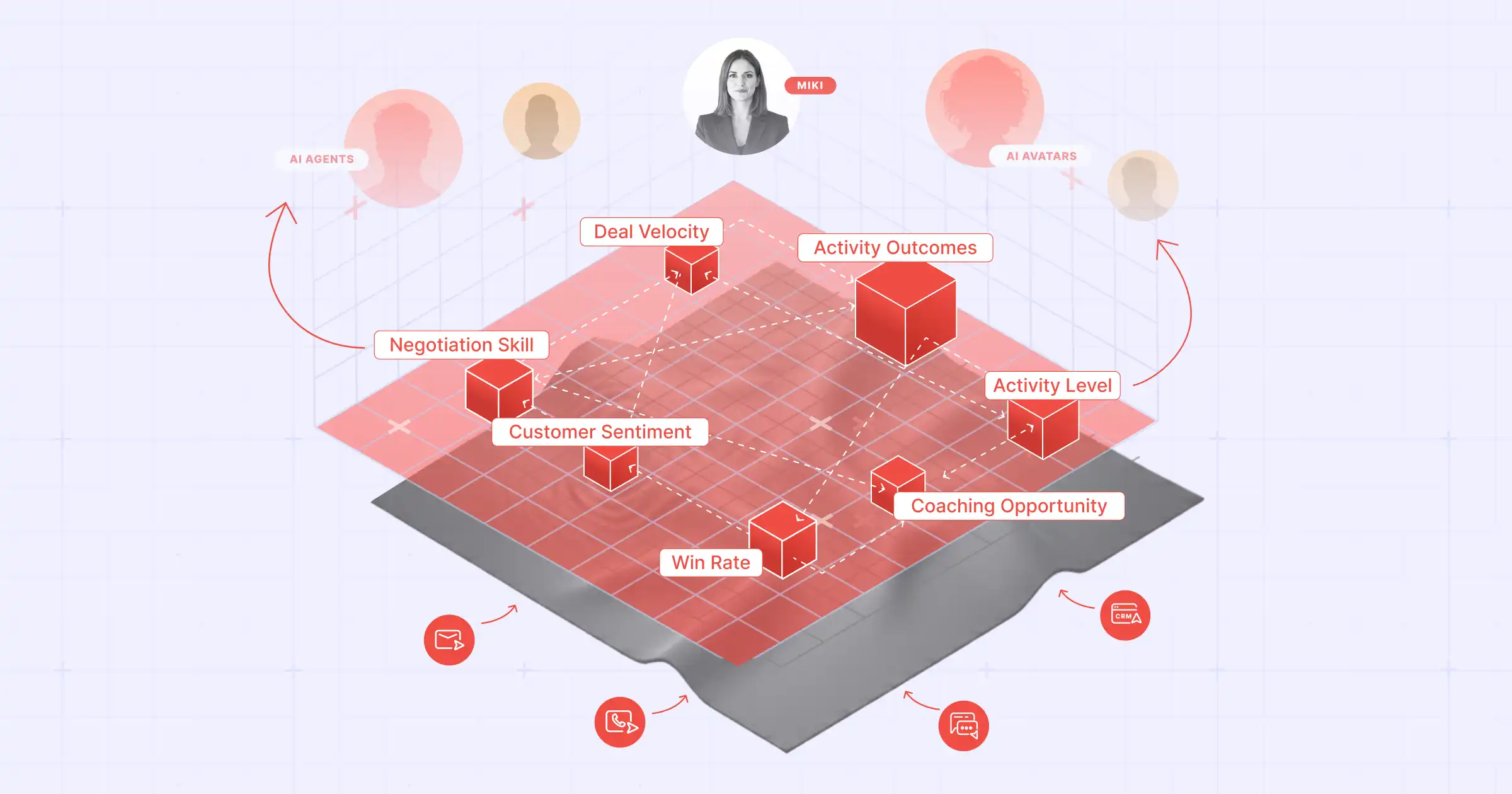

This is an important metric to measure throughout the quarter vs just at the end of it. This is a metric that should be evaluated at all levels - by VP, region, sales director, and even down to the AE. This metric reveals your vulnerability and allows you to make critical course adjustments in time to improve the team’s performance. With this metric, the CRO and sales leadership team can proactively evaluate themselves and make territory/headcount recommendations before questions come from the CFO and CEO. However, every time we ask CROs what percentage of the deals her/his team closes that are in “Commit”, they say some number greater than 80% and often, greater than 90%. Most sales organizations do not achieve this level of close rate. Here is an example of a straightforward dashboard from the Aviso system of aggregate data from a few sales teams in the 'high-tech’ industry. In this case, the data shows that they only close between 54% and 62% of the deals that are in commit throughout the Quarter. This is a clear indication of two things. First, deals that should be won are lost to the competition, or second, too many deals are slipping which reveals that many should never have been in "Commit" in the first place. In this case, an improved deal coaching strategy is needed.

Of all the opportunities in the “pipeline” (over 500) only between 4% and 8% closed. There are a lot of people chasing after deals that prove to be a waste of everyone’s time. This is obviously an issue. Most of these CROs knew there was a problem, but these specific statistics helped them to focus clearly and make adjustments to sales org strategy. It’s important to also assess how the percentages change as the Quarter progresses. The data reveals that they actually close more deals early in the Quarter that are in "Commit' than at the end. Most sales organizations close a larger percentage of what is still in commit towards the end of the quarter because if it is still in "commit", one would assume it is going to close. Here is another example. Similar issues as explained above.

Common Misinterpretations

A very important point to understand is that many sales leaders will say that they understand that all the deals aren’t closing this Quarter, but they will close in the next or in future Quarters, so these deals should stay in and be worked by the sales team. We constantly analyze the data and have found that only between 5% to 10% of non-closed deals actually close the next quarter. Hence, too many low-quality deals are making it into the pipeline and a significant amount of money and time is being wasted. Unfortunately, CRM systems do not have time-series database capabilities, so they can’t generate this kind of AI-driven analysis. You can through the tedious process of taking snapshots every week, saving the reports, and asking your sales operations people to spend hours crunching through numbers to get you these metrics but is that really good enough in the age of self-driving cars?