CAC Crisis Is a GTM Inefficiency Crisis: Aviso’s Agentic AI-Led GTM Execution the Only Way Forward

Aug 14, 2025

As Customer Acquisition Cost (CAC) payback periods reach record highs, Aviso shows why proactive, AI-driven GTM is the only path forward.

Recent data from Clouded Judgement paints a grim picture: the average CAC payback period for public SaaS companies is now 57 months. That’s nearly five years to break even on GTM spend. Even more sobering - this is not an outlier. Over the past 12 quarters, the average CAC payback has remained above 40 months.

Understanding the CAC Payback Problem

Customer Acquisition Cost for any enterprise gets evaluated as a ratio of total Sales and Marketing expenses of the company to the number of new customers those expenses have generated over the year.

The payback period on this CAC gets evaluated as the image below where we divide the CAC to acquire a new customer by the gross recurring revenue the customer contributes to the business. So in layman's terms, the CAC payback period tells you how many months or years it takes for your customer to “pay you back” the amount you spent to bring them in.

The persistently high average CAC payback period of over 40 months indicates underlying inefficiencies within the company's customer acquisition process. This metric reflects how long it takes for the revenue generated from a new customer to cover the initial sales and marketing investment. When this period extends beyond optimal levels, it suggests that the resources spent are not translating into proportionate customer lifetime value in a timely manner.

GTM inefficiencies—rather than macro conditions—are often the true culprit behind poor customer acquisition outcomes. These inefficiencies typically arise from misaligned strategies, such as ineffective channel selection, poor segmentation, or insufficient sales enablement. As a result, companies invest heavily in marketing and sales without seeing proportional gains, leading to inflated customer acquisition costs (CAC) and a delayed payback period. This mismatch reveals deeper issues in targeting, messaging, or sales processes that require urgent refinement to drive efficiency and return on investment.

Hidden Costs of CAC Inefficiency

High CAC payback periods hurt more than just margins. They expose operational dysfunction:

Inaccurate Forecasts: Overreliance on human judgment leads to missed quotas and misaligned pipeline expectations.

Revenue Delays: Committed deals don’t convert on time.

Rep Win Efficiency (Win Rate) Under Pressure: End-of-quarter push forces reps to trade quality for speed, reducing bookings effectiveness and squeezing margins

Low Rep Productivity: Reps spend more time managing tools than selling.

This all adds up to ballooning CAC and declining revenue efficiency.

The Solution: AI-Led GTM Execution

Aviso’s Agentic AI-led GTM execution that compresses time-to-value and aligns forecasts with reality. This approach is designed to significantly reduce the time it takes for a customer to realize value from a product or service (time-to-value). Furthermore, it aims to achieve a precise alignment between sales forecasts and the actual market reality, thereby improving accuracy and predictability in revenue generation.

How Aviso Controls CAC Volatility with AI-Driven Execution

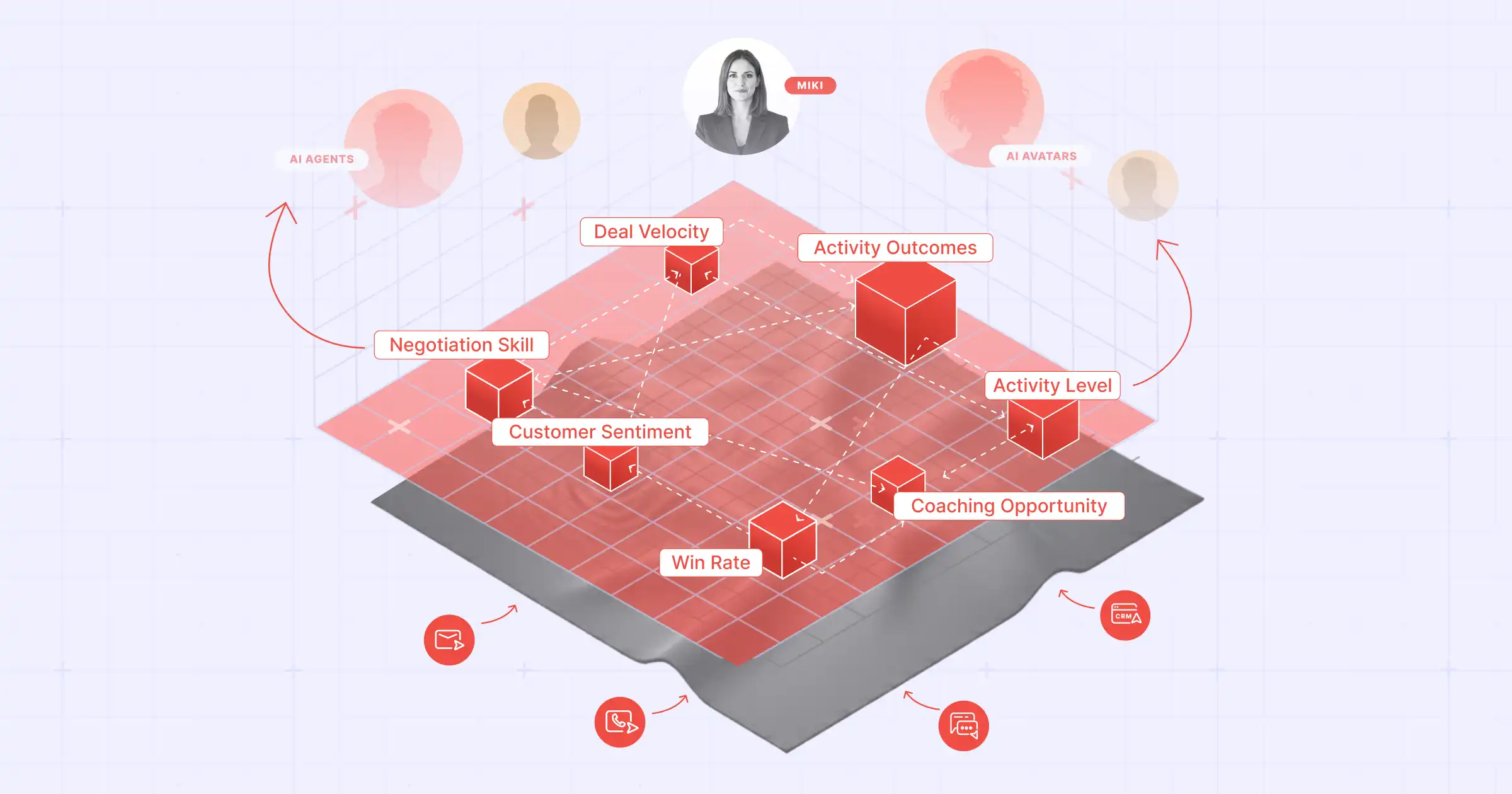

Aviso’s Agentic AI Workforce driven single platform for all GTM vision, brings precision and scale to every part of an Enterprise GTM motion:

AI Forecasting with 99+% Accuracy:

Human forecasts are right 20% of the time. Aviso AI forecasts are 99% accurate as early as Week 4 of the quarter.

Custom hierarchies and deal-level analysis help align forecasts with real-world recognition cycles.

Win efficiently at higher rate even under End of Quarter pressure:

Aviso identifies 68% of winning deals by Week 4 with 91% accuracy.

By removing end-of-quarter urgency and leveraging Aviso’s blended win score, reps identify winning deals early, push back deals at risk this quarter, and pull in high-potential opportunities from next quarter.

This targeted prioritization helps steer deals toward higher-quality wins, sustainably boost win rates, and protect margins thereby mitigating CAC inefficiency pressure on GTM Operations

Rep Productivity Uplift:

Customers using Aviso see up to $54K uplift per rep on average in net-new revenue booked per quarter.

Guided selling, AI nudges, and automated prospecting increase conversion and activity coverage.

Time-to-value optimization:

Features like Agentic workflows, Deal rooms, and Sankey pipeline maps help different categories of GTM users take precise action without context switching.

Time-to-value accelerates, GTM systems become self-correcting, and human error is minimized.

Save up to 20 hours per rep per week.

From CAC Chaos to GTM Confidence

In a world of soaring CAC, the answer isn’t more spend—it’s smarter execution. Aviso isn’t just a forecast tool. It’s the Revenue Intelligence OS built for:

CROs seeking forecast confidence

RevOps teams eliminating inefficiencies

Sales leaders and Line Managers coaching reps to peak productivity

As legacy GTM motions break down, Aviso’s platform is enabling a new operating model: Agentic GTM. One where the AI doesn’t just analyze, but acts.

AI isn’t coming for GTM jobs. GTM inefficiency is. But with Aviso, AI might just be the thing that saves them.

Curious to know more about how Aviso will be able to do this?

Get a sneak peek at what Aviso has to offer and see it in action.